Medicare is a health benefit you worked hard to earn.

We provide information as well as answers to your questions, so you can make the right choices and select a coverage option with the maximum benefit.

Let’s get started on your roadway to Medicare success!

We can help you prepare you for your transition to Medicare.

You must select one of the two:

Original government Medicare Parts A and B.

Plus Medicare Supplement and separate Part D drug coverage.

More expensive, Greater Doctor flexibility.

Insurance company sponsored Medicare Advantage, Part C.

Bundles hospital, doctor, and drug coverage, and generally offers some dental.

Less expensive, HMO or PPO network limitations.

Medicare is a federally funded program coordinated through the Centers for Medical Services (CMS), also known as ‘The Medicare Office’, or simply ‘Medicare’ and Social Security (SSA) that offers health insurance to American citizens and legal residents typically over the age of 65, and people with certain disabilities.

It was started in 1965 as part of President Lyndon B. Johnson’s ‘Great Society’ programs expanding social security benefits.

In 2006, under President George W. Bush, Medicare was expanded to include prescription drug coverage under Part D and Medicare Advantage Part C.

Medicare Advantage has grown substantially over the past 10 years, largely because of lower costs and ‘extra benefits’ not covered by Original Medicare, such as dental, vision, drug store credit, and transportation.

However, those ‘extra benefits’ are not totally free. There is a trade off in getting them.

We will explain the trade off, assess what you can afford, and enable you to select the best possible coverage.

At age 65, you become eligible for Original Medicare if:

Knowing when and how to enroll in Medicare is vital to avoiding late enrollment penalties as well as ensuring continuous coverage from your existing insurance to Medicare.

Specific enrollment periods were created to accommodate various life circumstances and changes.

First, let’s identify the different enrollment periods to determine which applies to you and your situation. Here are five key categories that guide when you enroll:

For some people enrollment is automatic.

If you are already receiving Social Security retirement benefits, which you can start anytime between age 62 and 70, you will be automatically enrolled in Medicare Parts A and B on your 65th birth – month.

Medicare will then begin deducting your Part B premium, presently 164.90, from your Social Security.

If you are presently receiving Social Security, are turning 65, and have existing health care insurance from a current or former employer, you may be able to save the $164.90 by delaying your Part B coverage. Please contact us for more details on this.

For most people enrollment is not automatic.

If you are not already receiving Social Security retirement, you are not automatically enrolled. Therefore, it’s important to know:

Initial Enrollment Period (IEP)

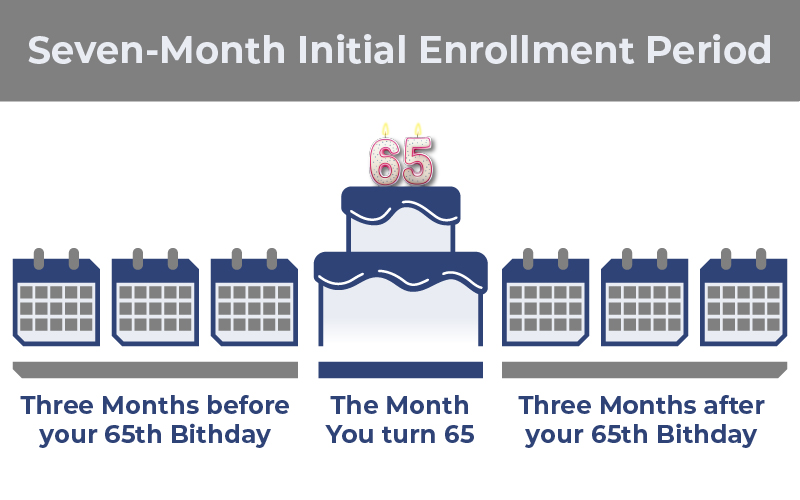

For most of us, the Initial Enrollment Period (IEP), which is triggered by our 65th birthday, is the first chance and the best time to enroll in Medicare.

Your IEP is a 7-month window that begins 3 months prior to your 65th birth month, includes your birth month, and the 3 months that follow your birth month.

It provides you the opportunity to enroll penalty-free in Medicare Parts A and B, as well as a Part D prescription plan.

Special Enrollment Periods for Working Past 65

Today, many people are choosing to work past age 65. By doing so, as an alternative to paying for Medicare Part B, you may elect to keep your employer benefits until you decide to dis-enroll from these benefits or retire.

When you dis-enroll or retire, you are eligible for a Special Enrollment Period (SEP) that would provide you an 8-month window to enroll in Parts B and D penalty-free.

Sometimes it is obvious that staying on employer coverage is better. Likewise, sometimes it’s obvious that switching to Medicare is superior.

Often, however, it’s not obvious. That’s where we at Turning 65 Medicare Choices come in. We have the expertise in Medicare to assist you in making the right choice, be it Medicare or staying on corporate insurance. Most corporate HR departments do not have the expertise in Medicare to assist you in this important choice. We encourage you to consult us before choosing.

If you elect initially stay on employer insurance, when you leave that coverage and go to Medicare, you will need to provide documentation to the Medicare office (CMS) verifying that you had qualifying coverage. Your employer will provide such documentation. If you have difficulty getting it, or knowing if it is the right document, let us know and we will help sort it out and get it right.

Special Enrollment Periods for Qualifying Special Circumstances

If you face life changes, depending on your situation, you could qualify for a Special Enrollment Period (SEP) to assist in enrolling and managing your Medicare benefits.

A SEP allows you to delay enrolling in Part B and D without incurring a late enrollment penalty (LEP). If you elected not to enroll for Parts B and D during your initial enrollment period (IEP), you would need to provide documentation of your Special Enrollment Period (SEP) eligibility to CMS in to avoid any penalties.

Special Circumstances approved by CMS to qualify for an SEP:

Determining Enrollment Period Eligibility

Not sure if this special enrollment period applies to you? Let us help you. We can explain when and how you’ll need to enroll to have the coverage you need, when you need it, without late penalties.

General Enrollment Period (GEP)

If you didn’t sign up during your Initial Enrollment Period, it is important that you contact us. We have expertise in understanding the ins and outs of the special enrollment periods and often can find one for you that is not obvious.

Without a special enrollment period, your enrollment could be delayed until the next, upcoming January1, leaving you without coverage and risk incurring lifetime late enrollment penalties.

Therefore, we strongly suggest that you enroll in Medicare during your Initial Enrollment Period. However, if you miss it, and you are eligible but late, contact us immediately. We can help.

Annual Enrollment Period and Medicare Advantage Open Enrollment Period

The Annual Enrollment Period, October 15 to December 7, annually, applies to changing your existing Medicare coverage. This includes the following changes:

The Medicare Advantage Open Enrollment Period, Jan 1 through March 31, applies to changing your existing Medicare Advantage plan only.

Let us do the research for you.

Turning 65 Medicare Choices eases the burden of exploring, choosing, and enrolling in a Medicare insurance plan that’s right for you based on your unique circumstances. Best of all, there is no cost for you for our services, and you receive our support with your Medicare needs for your lifetime.

The answer varies from household to household depending on your location, your income, and your coverage elections.

Most Americans, not on government assistance through Medicaid, pay somewhere between $165 and $400 per person, per month for Medicare. You have a choice as to where you want to be in that range of $165 to $400. We educate you so you understand your choices and make the proper selection.

The minimum premium payment to the government for Part B in 2023 is $164.90 (Note: we round it up to $165 in the above example). If you are receiving Social Security retirement this will be automatically deducted from your monthly amount. If you are not, you will have to pay Medicare directly by check, credit card or bank draft.

At a basic level, the costs associated with Medicare include:

Part B: 164.90 per month to the government.

Note: If your income – including income from investments – is above $97,000 single or $194,000 married, your Part B premium will be higher than $164.90. This is called IRRMA. These extra costs can be significant. Also, there are special circumstances and a process that may enable you to avoid this extra cost. We are experts in this area. Please contact us if this applies so we can review your situation.

PLUS: A range of 0 to $200 per month, to an insurance company, for Medicare Advantage or Medicare supplement premiums.

Varying amounts you must pay before coverage starts. Generally $0 to $300 per year, depending on your coverage selection.

General range of $10 to $45 per visit for Medicare advantage specialist, urgent care, or out of network visits. Usually $0 in Original Medicare with a supplement.

Co-pays in Medicare advantage appear to be small. However if you are using a fair degree of specialist care they can add up and reduce some of the cost savings in Medicare Advantage.

We will carefully review the cost of deductibles and co-pays in our education on plan selection. The ‘extra benefits’ of Medicare Advantage add value by reducing or eliminating the need the to pay in cash for:

However, while these extra benefits may look ‘free’ they are not. There is no free lunch.

The extra benefits are a tradeoff for accepting network coverage limitations, or specialist co-pays, of a Medicare Advantage HMO or PPO plan.

We will work with you, helping you understand if that trade-off is a good one.

If you don’t sign up for Parts A, B and D during the appropriate enrollment period when you’re first eligible, you assume the risk of incurring a separate late enrollment penalty (LEP) for each of these Medicare parts. These LEPs can be added to your monthly premium and can be costly.

LEPs can last for as long as you keep your Medicare coverage, which, for most, is your lifetime! It’s important to make sure you understand your enrollment periods and how to comply.

We’ll assist you through every step of the Medicare enrollment process; If you are not automatically enrolled as a result of already being on Social Security retirement benefits, you will have to sign up for Medicare through Social Security.

Step one: Initial sign up through Social Security for Medicare Parts A and B

This can be done:

if you select the online option you will have to create a user id and password on ssa.gov. this will involve uploading a picture of your ID to id.me.

You may also receive a passcode to create credentials on ssa.gov. This would be mailed to you after calling Social Security.

Creating an ID or visiting your Social Security office post Covid can be tricky. We will guide you through the process you choose and make sure it works properly.

While technically still allowed, our present experience is that Social Security is discouraging enrollment by mail or fax and not accepting phone enrollments.

We suggest a visit to a Social Security office or online. We can assist you in selecting the right option.

Step two understand and select your benefit options:

You must choose one of the basic options.

Choice one: Original Medicare, parts A and B.

plus Medigap and Drug, Part D

Choice two: Medicare Advantage, or Part C

What’s best will depend on your medical needs and preferences as well as your financial situation and budget.

We provide an understanding of the pros and cons of each option so you can make an informed choice. We uniquely possess experience as financial professionals to assist you in making this financially based choice.

If you choose Medicare Advantage, we will help you set up your best possible doctor and hospital access within the HMO or PPO network best suited for you. You may have to replace an existing doctor if he or she is out of network. We will help you do that.

If you choose Original Medicare plus a Medicare Supplement, you can see any doctor or go to any hospital in the country that takes Medicare, at your choosing. Most do. So you will be able to keep all your existing doctors or select new ones from the broadest available pool.

By the way, Drug coverage also varies plan to plan, whether it is a separate Part D plan, that would be part of an Original Medicare solution, or a bundled drug plan as part of Medicare Advantage.

All drug plans have preferred lists of drugs called formularies. With Medicare advantage, fitting the most suitable formulary with the best possible HMO or PPO doctor network is a challenging part of making a Medicare Advantage plan work. We will work with you to optimize putting these pieces together. It’s tricky and requires industry expertise.

Whereas, in Original Medicare with a separate Part D drug plan, fitting drug coverage and a doctor network together is not a concern. That’s because there are no doctor networking restrictions. Therefore, you can pick whatever separate drug plan best suits you — independent of doctor coverage.

This is another one of the variables or trade-offs in your basic decision on selecting Original Medicare or Medicare Advantage.

This important choice is a function of your budget, medical needs, and preferences. We will guide you to your best possible and most cost-effective choice. There is no cost for our service.

Once we have answered your questions so you make the right basic choice, we will make sure:

We provide expert education before, during, and after enrollment:

Medicare or Social Security will never INITIATE communication with you through phone, text, or email. If they want to reach you at their initiative, they will send you a physical letter – the old fashion kind, paper in an envelope – to your mailbox.

If you receive an uninvited call, email, or text from someone claiming they are from Medicare or Social Security, it is not legitimate.

However, if you call Medicare or Social Security you will have an option of leaving your number for a call back. If you do that, remember to write down that you did it so you will recall when they call back, usually later that day or the next day, that you requested the call.

You may get calls from insurance salespeople saying something like “this is John Smith from your areas leading Medicare Plan”, or this is John Smith from Medicare Information.org.

They are not supposed to be calling you without your prior permission. Act with caution.

By the way, many Medicare insurance sales companies are using .org in their websites to make it look like they are non-profit information sources. You will notice that we at Turning65MedicareChoices.com don’t do that. We are an independent Medicare information and enrollment company.

We assist you at no cost. Medicare insurance companies compensate us for assisting you.

We provide unbiased advice and make an honest living doing it. We are proud to identify ourselves clearly & honestly with a .com domain as a commercial business.

We welcome working with you.

As you know, TV advertising for Medicare has increased dramatically over the past few years. Ads are aggressively pressuring those over 65 to call them, making claims about ‘cash back’ and other extra benefits they claim you are missing out on.

What they don’t tell you is that if you are getting cash back you are reducing your coverage. There is no free lunch.

This is just one example of deceptive practices in an industry that, to say the least, is not well behaved. We don’t feel that we are going out on a limb to call it a ‘dirty industry’.

Be aware that once you call an 800 number from a TV ad or an insurance company, you are giving them permission to sell to you.

If you don’t want to give that permission, don’t call. But if the curiosity is overwhelming, we strongly recommend that you discuss any recommendations made by a call center or an insurance company with us before making any decisions or coverage changes.

Also note: if you call an insurance company, or go to one of their sponsored lunches, their salespeople can only sell you their products. They will do their best to do that.

However, with 5 to 10 insurance companies offering Medicare in most areas, how do you know if that company is your best choice? Reality is, you probably don’t.

Can you believe that we speak with 300 people per year about their Medicare coverage and most of them, including those on Medicare for several years, cannot accurately describe the coverage they have, or why they have it in relationship to other options available.

I can only think of one explanation as to why this is the case.

Insurance companies are good at telling you part of the story, not the whole story, creating confusion, and then selling you something.

We are different.

We are not an insurance company. We are not employees of an insurance company.

We are independent advisors that represent most of the insurance companies offering Medicare coverage in your area. But we do not work for them and are not in partnership with them.

Instead we are in partnership with you.

We educate you on selecting the best coverage amongst the list of insurance companies providing Medicare coverage in your area.

Our compensation is the same no matter what coverage option — of several we will present — you select.

We are unbiased. We educate you and let you choose.

Our service doesn’t end at enrollment. We offer free lifetime support to you, including annual plan reviews as well as help with relocations or major life changes.

Do You Qualify for a Special Enrollment Period because of a life changing event?

A SEP allows you to delay enrolling in Part B and D without incurring a late enrollment penalty (LEP).

We can help you navigate any Medicare related changes due to life changing circumstances.

Each year, Prescription drug plans Part D and Medicare advantage plans part C are allowed to submit proposed changes to their plans for the upcoming year to Medicare. If those changes are reasonable, and do not alter the basic structure or benefits of the plan, they are generally approved by Medicare. If a plan you are in is changing you will receive, by mail, an Annual Notice of Changes (ANOC).

New plans, often with improved benefits, are also introduced each year.

An annual plan review also gives you the opportunity to review any changes in your plan or medical situation, learn of new plans or alternative options for coverage to prepare for the Annual Enrollment Period (AEP). It is free of change from us for life. Please take advantage of it.

The professionals at Turning 65 Medicare are here to help.

We would be honored to assist you.

Please fill out the form to speak to a specialist.